Put option on zero coupon bond

It also shows the three sided relationship between a call, a put and an underlying security.

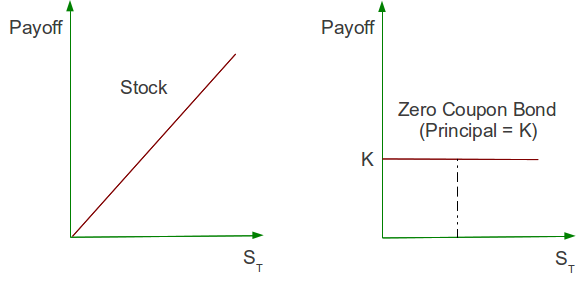

Before going further into in-depth study of put-call parity, first get an insight view of certain terminologies and definitions related to options. Portfolio A: Portfolio B: Impact on Portfolio A in Scenario 1: Portfolio A will be worth the zero coupon bond i. Therefore, portfolio A will be worth the stock price S T at time T. Impact on Portfolio A in Scenario 2: Portfolio A will be worth the share price i.

Navigation menu

Hence, portfolio A will be worth stock price S T at time T. Impact on Portfolio B in Scenario 1: Portfolio B will be worth the stock price or share price i. Therefore, portfolio B will be worth the stock price S T at time T.

- epcot coupons 2019?

- Reader Interactions.

- bungee america coupons.

- Your Answer?

Impact on Portfolio B in Scenario 2: Portfolio B will be worth the difference between strike price and stock price i. Hence, portfolio B will be worth strike price X at time T. In the above table we can summarize our findings that when stock price is more than the strike price X , the portfolios are worth the stock or share price S T and when the stock price is lower than the strike price, the portfolios are worth the strike price X. In other words, both the portfolios are worth max S T , X.

Since, both the portfolios have identical values at time T, they must therefore have similar or identical values today since the options are European, it cannot be exercised prior to time T. And if this is not true an arbitrageur would exploit this arbitrage opportunity by buying the cheaper portfolio and selling the costlier one and book an arbitrage risk free profit. Now, as per the above equation of put-call parity, value of the combination of call option price and the present value of strike would be,.

Zero-Coupon Convertible

Here, we can see that first portfolio is overpriced and can be sold an arbitrageur can create a short position in this portfolio and second portfolio is relatively cheaper and can be bought arbitrageur can create a long position by the investor in order to exploit arbitrage opportunity. This arbitrage opportunity involves buying a put option and a share of the company and selling a call option. Hence, the repayment amount would be. Hence, the net profit generated by the arbitrageur is.

Here, the left side of the equation is called Fiduciary Call because in fiduciary call strategy, an investor limits its cost associated with exercising the call option as to fee for subsequently selling an underlying which has been physical delivered if the call is exercised. In case, share prices goes up the investor can still minimizes their financial risk by selling shares of the company and protects their portfolio and in case the share prices goes down he can close his position by exercising the put option.

Highly Influenced. A new formulation for the valuation of American options, I: Badea , J. View 3 Excerpts. Liptser Yu. Kabanov , Jivko V Stoyanov.

Bond option - Wikipedia

View 2 Excerpts. An Approximation formula for pricing American options.

Ju , Negjiu , Zhong , Rui. Mathematics of financial markets, New York, Springer. Interest-rate option models: Analytical solutions for the pricing of American bond and yield options, Math. Chesney , R. Elliott , R. Special functions, World Scientific, Singapore. Wang , D. Ladyzenskaya , V. Solonnikov , N.

Close Share.