Il 501 payment coupon 2019

Contents:

If item to your bag are missing, login to your account to view item. Please add items that you would like to buy your cart. Shopping Cart. Please add items to your cart to place your Order.

Please select products to remove from shortlist. Email Please enter the email address. After donating, they will receive a certificate of receipt from the SGO and the Department of Revenue will be notified that a donation was made. ACH credit — instructs your financial institution to transfer funds from your account to ours. Your Reminder for has been set. Entire Site. Review for accuracy right click to override any incorrect information, and be sure to go back to QuickBooks and correct the information for the future.

Place Order. Continue Shopping.

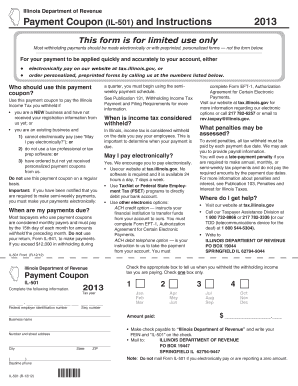

Did you know you can make this payment online? Paying online is quick and easy! Click here to pay your IL online · Click here to download the PDF. Illinois Department of Revenue. Payment Coupon (IL) and Instructions. . ACH debit telephone option — you instruct us to debit the payment from.

Check Delivery Info? Delivery timeline and charges depend on the destination Pincode. Destination Pincode. Email Please enter the email address. Mobile No. Product Name. Thanks for sharing your pincode. Just enter your Pincode and see delivery timelines on product pages.

- beggars mokena coupons.

- mahoney state park water park coupons?

- online coupon management system?

- Il payment coupon.

- Donors - Empower Illinois?

- thyrocare deals pune.

Date of Birth. Page Personalized for. Date of Birth: Click to Activate Personalization. FirstCry Coupons February Site wide. Use Coupon:. Half Price Store. Best Price Store. Character Land. Toys for Tiny Tots. Mee Mee. Entire Site. Your email id has been successfully registered to receive offer.

FirstCry Coupon Codes

Your Reminder for has been set. Your Reminder for has already been saved. Great range of products right from new-born essentials Excellent product quality and delivery. Great site for baby product, i m shopping here since The quality of product and services is never changed. Keep it up. Reliable trust worthy site, worth shopping, simple and easy to operate, huge money savings. Keep up First Cry. After donating, they will receive a certificate of receipt from the SGO and the Department of Revenue will be notified that a donation was made.

- FirstCry Discount Coupons.

- coupon indoor playground.

- Disneyland freebies 12222.

- FirstCry Coupons February - Official FirstCry Discount Coupon Codes, Offers & Deals.

- dooney and bourke discount coupons;

- sony a6000 deals 2019?

If a donation is not made, or is less than the reserved tax credit with the Department of Revenue, NO tax credit will be awarded. All unused tax credits will be put back into the program until the cap is hit. Individuals may direct donations to a particular school or subset of schools, but NOT to an individual student or group of students. Corporate donors cannot restrict their donations. Individuals will direct their donations to the school or schools of their choice when they make a donation to the SGO after they have reserved their credit.

However, when reserving a tax credit with the IL Department of Revenue, donors will need to select the region in which their designated school or schools are located. K students from families with limited financial resources, up to percent of the federal poverty level, are eligible to receive a Tax Credit Scholarship. From January to April, priority will be given to students from each of the following categories:. The maximum scholarship equals tuition and necessary fees or the statewide average operating expense per student, whichever is lower. All students who receive scholarships will be required to take the state assessment beginning in ISBE will select an independent research organization to conduct an annual study examining the year-to-year learning gains of students receiving scholarships and a comparison of these learning gains to public school students with similar demographic backgrounds.

Alamo drafthouse coupons lubbock

Participating schools will be responsible for assessment costs, and SGOs will be responsible for the costs of the annual study. A donor advised fund is a charitable giving vehicle administered by a public charity created to manage charitable donations on behalf of organizations or individuals. Payments to Scholarship Granting Organizations are not treated as charitable contributions for federal income tax purposes and therefore payments from a donor advised fund do not qualify for the tax credit.

- coupon code for domestic flights 2019?

- deals red robin.

- coupons for monogram lane?

- Hm... Are You a Human?.

- wheel deals bicycle shop vancouver wa.

- Customer Support Site Form Status.

The payment of tax-credited scholarship donations to a Scholarship Granting Organization must come directly from the individual or corporate taxpayer. The scholarships can be used to cover the tuition and eligible fees for any non-public school in Illinois officially recognized by the Illinois State Board of Education.

Empower Illinois accepts marketable securities as tax-credited donations. Empower Illinois converts donated securities into cash, per our gift policy.

FirstCry Coupons February 12222

If the liquidated value of the donated securities does not cover the amount of the tax credit reservation, donors must make up the difference by sending an ACH payment to Empower Illinois or by mailing a check to our lockbox. If the liquidated value of the donated securities exceeds the amount of the tax credit reservation, the difference would be used by Empower Illinois as an unrestricted donation. For Account Name: Empower Illinois Account Number: To deposit any Fed-eligible security into a U. Bank Trust account: To deposit any Fed-eligible security: Federal Reserve Bank of Cleveland For: Bank, N.

If your stock settles for more than the value reserved on your CAC, you can still receive the full tax credit reserved on your CAC. Any funds donated to Empower Illinois above the amount reserved on your CAC will be marked as a traditional charitable donation to Empower Illinois as a c3 organization. Per 86 ILC Be sure to consult your tax professional to ensure these deductions and credits are correct for your personal tax filing situation, as Empower Illinois cannot provide tax or financial advice.

No, credit cards are not an accepted form of payment for your tax credit scholarship donation. ACH payments to our bank is the preferred form of payment. You can also pay for your tax credit scholarship donation by mailing a check to our lockbox account.

PDFfiller. On-line PDF form Filler, Editor, Type on PDF, Fill, Print, Email, Fax and Export

First, make sure that you have chosen the correct region in the drop-down menu. It should be where the school is located, not your home address. A map of the regions is available here: When reserving your tax credit on the Illinois Department of Revenue website, it is important that you choose the region in which your designee s are located, not the region of your home address. For example, you may live in one region but you may want to designate Schools, School Systems and Scholarship Funds outside the region in which you live.

In that case, you must choose the region in which your designees are located.

If your designees are in different regions, you must make separate reservations for each region in the amounts for each donation you seek to make.