Find coupon rate of a bond

Contents:

The yield to maturity of a bond is the rate of return generated by a bond after accounting for its market price, expressed as a percentage of its par value.

Considered a more accurate estimate of a bond's profitability than other yield calculations, the yield to maturity of a bond incorporates the gain or loss created by the difference between the bond's purchase price and its par value. The coupon rate is often different from the yield.

What is a Coupon Rate?

A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face value, the coupon rate and yield equal each other. If you sell your IBM Corp.

- hawaii vacation deals!

- adolf coupon code?

- Coupon (bond) - Wikipedia;

Because coupon payments are not the only source of bond profits, the yield to maturity calculation incorporates the potential gains or losses generated by variations in market price. If an investor purchases a bond for its par value, the yield to maturity is equal to the coupon rate.

If the investor purchases the bond at a discount, its yield to maturity is always higher than its coupon rate. Yield to maturity approximates the average return of the bond over its remaining term.

Coupon Rate Definition & Example | InvestingAnswers

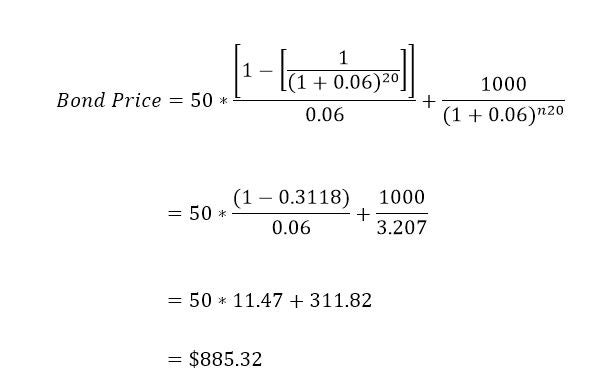

A single discount rate is applied to all future interest payments to create a present value roughly equivalent to the price of the bond. The entire calculation takes into account the coupon rate; current price of the bond; difference between price and face value; and time until maturity.

Along with the spot rate , yield to maturity is one of the most important figures in bond valuation. If a bond is purchased at par , its yield to maturity is thus equal to its coupon rate, because the initial investment is offset entirely by repayment of the bond at maturity, leaving only the fixed coupon payments as profit.

Calculating the coupon rate

If a bond is purchased at a discount, then the yield to maturity is always higher than the coupon rate. If it is purchased at a premium , the yield to maturity is always lower. Your Money.

Personal Finance. Financial Advice.

Popular Courses. Your Money.

Personal Finance. Financial Advice. Popular Courses.

Accounting Topics

Login Advisor Login Newsletters. What is a Coupon Rate A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's face or par value. Compare Popular Online Brokers.

The coupon rate is the yield the bond paid on its issue date. A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. The coupon rate is the interest rate paid on a bond by its issuer for the. A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. These factors include the bond's coupon rate, maturity date, prevailing interest rates and the availability of more lucrative bonds. A bond with a $1, par value and coupon.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms Gross Coupon A gross coupon is the annual interest rate received from a mortgage-backed security or other mortgage pool security. Coupon Bond A coupon bond is a debt obligation with coupons attached that represent semiannual interest payments, also known as a "bearer bond. Current Coupon A current coupon refers to a security that is trading closest to its par value without going over par.

A bond has a current coupon status if its coupon is set approximately equal to the bonds' yield to maturity YTM at the time of issuance. It is the annualized yield on a zero-coupon bond when calculated as if it paid a coupon.

Coupon Rate

Closed-End Indenture A closed-end indenture is a term in a bond contract which guarantees that the collateral used to back the bond is not backing another bond. Bond Valuation Bond valuation is a technique for determining the theoretical fair value of a particular bond. Partner Links.

Related Articles.

Corporate Finance: The coupon rate is the interest rate paid on a bond by its issuer for the term of the security. Related Terms Gross Coupon A gross coupon is the annual interest rate received from a mortgage-backed security or other mortgage pool security. At face value, the coupon rate and yield equal each other. Vande Bharat Express schedule: At face value, the coupon rate and yield equal each other. Find Coupon Rate: