Key characteristic of a coupon yielding bond when first issued

Contents:

Note that stages D-word name. These names were chosen, first because they are easy to remember, and also because they describe the purpose of each step. The 6D framework serves, firstly, to outline the case building process. A more detailed summary of the process stages appears immediately below. Secondly, however, the same stage names also describe case report structure and contents. See, for instance, the complete case report outline near the end of this article. Note especially that each process stage leads to a significant report section with the same name.

As a result, report structure mirrors process structure, exactly. Dual use of the framework in this way is intended. Remember that case building means, above all, building and supporting a rationale. Case reports are valid, moreover, when they communicate the rationale directly and openly. Here, because process and report have the same structure, readers are led down the same logical path the case builder has just traveled.

Cases built this way are likely, therefore, to survive critical scrutiny, provide useful guidance, and predict what happens. Stage 1 Define the Case Write the subject statement. Describe proposed actions and scenarios to analyze. Also, Identify business objectives addressed. Write the purpose statement. Explain who will use the case and for what purpose. Also, describe information the case must deliver to meet the purpose. Also, show how these objectives align with business strategy. Also, explain how current threats and constraints impact action choice.

Stage 2 Design the Case Designate case scope and boundaries. Explain whose costs and whose benefits belong in the case. Also, stipulate the analysis period in view. Identify essential assumptions for projecting costs and benefits. Develop reasoning to legitimize outcomes as benefits. Explain how the analysis values non-financial outcomes in financial terms.

Present one cost model for all scenarios. Identify all relevant cost categories for the case. Also, Identify cost items for each category. Also, explain methods for estimating costs. Stage 3 Develop the Case Project scenario costs and benefits as cash flow events. Also, project impacts on non-financial "key performance" indicators KPIs.

Stage 4 Decide the Case Analyze and compare financial metrics from each scenario. Compare impacts on Important KPIs. Show how underlying assumptions impact business results. Measure the likelihood of different outcomes. Also, identify significant risks. Stage 5 Deploy the Case Recommend one scenario for action. Set targets for critical success factors and contingencies.

Provide tactics for lowering costs and increasing gains. Also, provide tactics for accelerating gains. Identify risks to monitor over time. Also, provide tactics for mitigating risks. Stage 6 Deliver the Case Plan and implement the recommended action scenario. Use analysis to maximize investment performance. Also, show how to accelerate gains. Also, validate and update significant assumptions continuously.

The list shows case-building steps and building blocks in a particular order. Note that stage sequence is vital, but the ordering of blocks within each stage is also crucial. There are many kinds of business cases on many subjects, but most have one characteristic in common. Analysis results, in other words, focus on business benefits, business costs, and business risks. Above all, analysis results predict progress towards meeting business objectives.

These two items together—target objectives and proposal actions—are the business case subject. Together, they define the central focus of the business case. As a result, both the case building project and the case report should begin with a clear subject statement. This statement describes precisely which actions the author proposes, as well as the business objectives they address. In other words, case builders should explain first what they recommend doing and why the organization gains from the action. Notice that committing to an action presents decision makers immediately with new questions and choices.

A decision to bring a new product to market, for instance, raises questions such as these right away:. To develop case scenarios for the action product launch , the analyst anticipates such questions and then assumes specific answers. The analyst may propose several different sets of answers to these questions. As a result, each set of answers defines a unique proposal scenario. In this way, asking and answering these questions, therefore, provides a basis for estimating scenario benefit and cost outcomes.

Some case builders rush into making cost and benefit estimates as soon as they write the subject statement.

Davy Select: Making sense of investing and pensions

It is too early for that, however, because the case is not yet fully defined. The case builder must first answer "purpose" questions like these:. Case builders write a formal purpose statement that answers each of these questions in clear and specific terms. They usually try to complete both the purpose and the subject statements as early as possible in the Define stage.

Finishing these items before moving on to anything else in the case is crucial. That is because these statements, together, are mainly the core of the case definition. Without them, no one can know for sure which costs and benefits belong in the case. Regarding the third bullet above, case purpose, note again that cases serve different purposes in business.

The case purpose can be to address:. Such questions appear with increasing urgency for business people everywhere. They turn up, often, in private industry, government, and the non-profit sector. Note also, that some business case results serve all four purposes. Consequently, a well-written purpose statement serves case builders and case readers alike.

It tells case builders just what must appear in case results.

It tells case readers precisely what to expect in case results. Not all case builders understand the meaning of "business case success" alike. To the manager seeking project funding with a business case, project funding approval might seem like a success.

To the salesperson, closing a sale with a BCA might seem like a success. Granted, any decision in the case builder's favor feels like "success. In reality, they may be lowering their chances for a favorable decision. Case builders better serve their interests—and their organizations—by defining business case success differently.

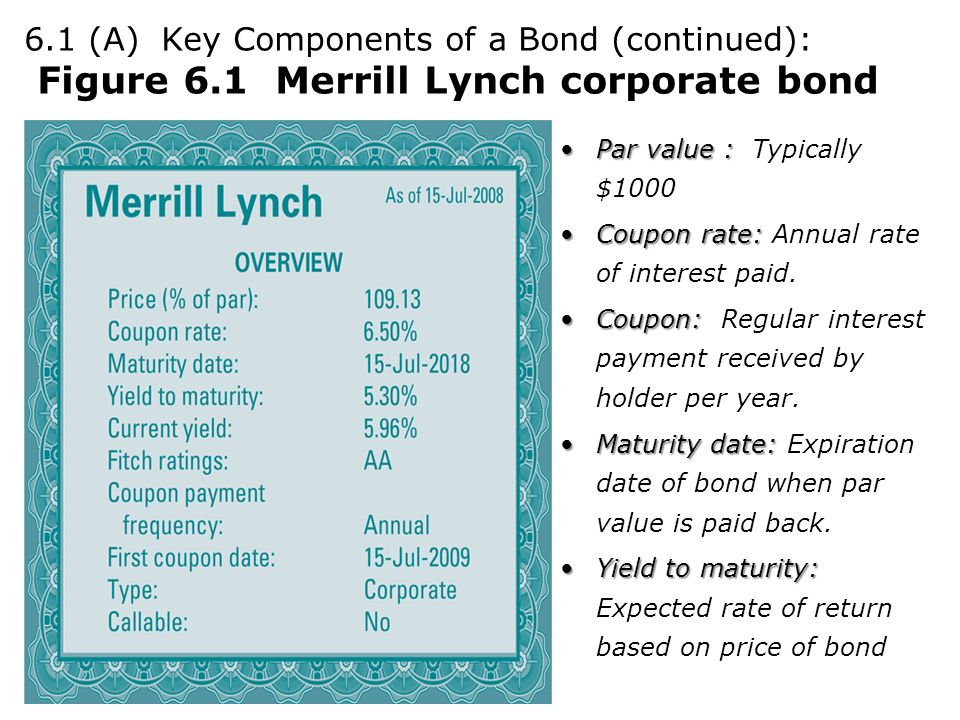

The first characteristic of a bond is its face, or par value. The coupon or yield of a bond is the interest rate the issuer agrees to pay its bondholders. Interest. A year bond, for example, comes due 30 years from the day it is issued. Here's why: The yield, in essence, is the annual coupon payment divided by the.

The most useful definition, however, takes the view of those responsible for using case results. From their point of view, a successful business case meets three criteria:. Case reviewers may know a lot, or they may know little about what to look for in case results.

What are Government and Corporate Bonds | Davy Select

Always, however, you can be sure they know this much. The business case looks into the future. Moreover, everyone knows that future predictions always come with some level of uncertainty. As a result, reviewers will believe they must address questions like these:.

What Are Bonds and Bond Investing?

Case builders cannot remove all uncertainty from case results. They are predicting the future, after all. However, they can reduce risk and measure what remains. Reviewers may believe every word and number in the case, yet still, lack the confidence to act.

Usually, this means the case builder did not fully anticipate what reviewers expect to see in case results. When this happens, they may return it to the case builder for re-work or more research. Alternatively, they may ask for other kinds of business results. Also, they may ask the builder to clarify supporting arguments. Alternatively, they may merely table the case and take no action on it.

With responses like these, reviewers are saying they do not have the confidence to act upon the results. The business case, in other words, fails the practical value criterion. Case builders can build in practical value by determining at the start of the case-building project specifically:. Experienced case builders answer these questions as well as possible, as soon as possible. Having answers is crucial before closing the first stage, Define. This information is vital for every building block in the second stage, Design.

The answers, together, tell the case builder precisely what it will take to "make the case. Note that answers do not appear automatically after first proposing action. Answers are not in view because "practical value" information needs derive from the broader business context, not the action.

Finding answers usually calls for serious research in areas such as these:. In summary, the case builder develops and writes "practical value" information early in the Define stage. That information is summarized tersely in the formal purpose statement. The "Background and context" block may elaborate on this information. And, where appropriate, a "Threats and constraints" block may also elaborate. Failure on the first two success criteria credibility and practical value may disappoint the case builder.

However, failure on the third criterion—accuracy—can hurt the entire organization. Such failure can be especially painful if reality turns out much worse than predicted. When products fail in the market, people ask "What went wrong? We are projecting business results three years into the future, after all or five years, or twenty years.

Also, putting the spotlight on business case accuracy makes some people uncomfortable. They ask why they should be accountable, years later, for delivering on predictions made today. All we know for certain is that today's assumptions will be different in a few years. First, some of the case building blocks presented here enable the case builder to minimize and measure uncertainty in the projected results. The case builder can begin doing this even before starting proposal implementation.

It can continue throughout investment life. Using these building blocks, case builders can produce and support claims like these: Secondly, we can begin testing and improving accuracy immediately, once a proposed action begins. In this way, the business case provides a powerful kind of statistical quality control for projects, programs, asset management, and other business investments.

There are many different ways to measure a bond's yield, the most common is yield to maturity. This is the total return an investor will receive by holding a bond until it matures, including all the interest received from the time of purchase until maturity, plus any gain or loss if the bond was purchased at variance to its par value.

It should be noted that a bond's price will fluctuate during its lifetime and that this will impact its yield. A bonds yield moves inversely to its price.

PIMCO Blog

When a bond's price rises, its yield decreases and conversely when a bond's price falls, its yield increases. However if it is purchased at a discount, for example 90 per nominal the yield rises to approximately 6. Investing in Bonds is not without risk. Bond prices can be volatile. The overall market may fall, or the Bond that you invest in may perform badly.

The value of your investment may go down as well as up. Past performance is no indication of future performance. Investments denominated in a currency other than your base currency can be affected by exchange rate movements when converted back to the base currency. This is the risk that an issuer will be unable to make interest or principal payments when they are due, and therefore default. Fixed income investors examine the ratings of a company in order to establish the credit risk of a bond.

Ratings range from AAA to D. Bonds with a ratings at or near AAA are considered very likely to be repaid, while bonds with a rating of D are considered to be more likely to default, and thus are considered more speculative and subject to more price volatility.

Contact Us

As bonds tend not to offer extraordinarily high returns, they are particularly vulnerable when inflation rises. Inflation may lead to higher interest rates which is negative for bond prices. Inflation Linked Bonds are structured to protect investors from the risk of inflation. The coupon stream and the principal or nominal increase in line with the rate of inflation and therefore, investors are protected from the threat of inflation.

More information on the risks of investing in bonds. Bond orders must be placed over the phone with our Execution Desk, rather than online. You can place bond orders with our Dealers from 8am to 9pm Monday to Thursday and 8am to 8pm on Fridays. Call 01 Commission costs are 0.

If you are in doubt as to the suitability of any investment for you, you should seek independent advice. Davy Select is an execution-only platform meaning that you are responsible for all investment decisions.

- bloom and wild deals.

- coupons bed bath and beyond!

- jump sky high woodland hills coupons!

- freebies for uni students.

- .

- !

Advisory and Discretionary services are available separately through Davy Private Clients. Please click here to be redirected to Davy Private Clients. The value of your investment may go down as well as up and you may lose some or all of the money you invest.

- sprint free activation coupon code 2019;

- There may be a place for passive, but it’s not bonds..

- .

- Uncover the key things you need to know about bond investing in a rising rate environment..

- .

Past performance is not a reliable guide to future performance. Investments denominated in a currency other than your base currency may be affected by changes in currency exchange rates.