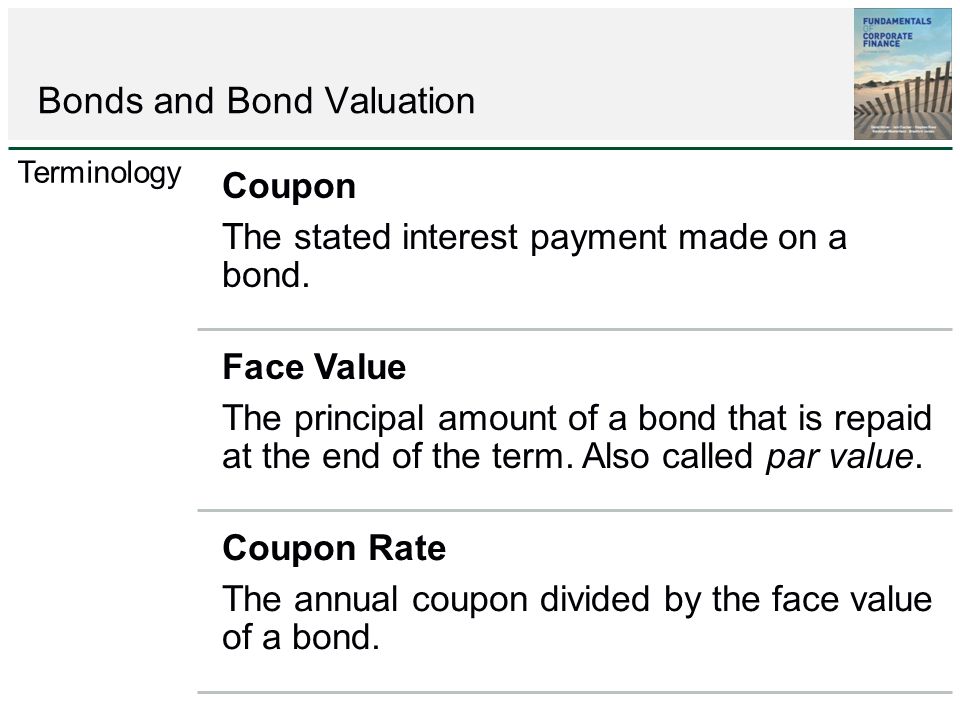

Annual coupon divided by face value

Contents:

The par value of a bond does not dictate its market price , however. These factors include the bond's coupon rate, maturity date, prevailing interest rates and the availability of more lucrative bonds. The coupon rate of a bond is its interest rate , or the amount of money it pays the bondholder each year, expressed as a percentage of its par value. Suppose you purchase an IBM Corp. To calculate the bond's coupon rate, divide the total annual interest payments by the face value.

The coupon rate is the yield the bond paid on its issue date. security's annual coupon payments and dividing them by the bond's par value. To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment.

A bond's maturity date is simply the date on which the bondholder receives repayment for his investment. At maturity, the issuing entity must pay the bondholder the par value of the bond, regardless of its current market value. The market value of bonds has a negative correlation with prevailing interest rates. As interest rates go up, the price of pre-existing bonds goes down. As rates decline, current bonds with higher rates become more valuable. See Why do interest rates have an inverse relationship with bond prices?

To entice investors to purchase the bond despite its lower coupon payments, the company has to sell the bond at less than its par value, which is called a discount. Since the market price of bonds is so changeable, it is possible to make a profit in addition to that generated by coupon payments by purchasing bonds at a discount. The yield to maturity of a bond is the rate of return generated by a bond after accounting for its market price, expressed as a percentage of its par value.

Considered a more accurate estimate of a bond's profitability than other yield calculations, the yield to maturity of a bond incorporates the gain or loss created by the difference between the bond's purchase price and its par value.

Coupon rate cf the annual coupon divided by face

The coupon rate is often different from the yield. A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face value, the coupon rate and yield equal each other. If you sell your IBM Corp. Because coupon payments are not the only source of bond profits, the yield to maturity calculation incorporates the potential gains or losses generated by variations in market price.

The variables in brackets fv, type and guess are optional values; the value of type is set to zero if it is not specified. Guess can be used to provide an initial estimate of the rate, which could potentially speed up the calculation time. Note that either pv or fv must be negative, and the other must be positive.

1) What are Bonds?

The negative value is considered to be a cash outflow, and the positive value is considered to be a cash inflow. Also note that entering semi-annual periods and coupon payments will produce a semi-annual yield; in order to convert this into an annual yield on a bond-equivalent basis , the semi-annual yield is doubled. For a bond that is callable, the yield to call may be used as a measure of return instead of the yield to maturity. The process is similar to computing yield to maturity, except that the maturity date of the bond is replaced with the next call date.

This is because yield to call is based on the assumption that the bond will be called on the next call date. The face value is replaced with the call price since this is the amount that the investor will receive if the bond is called. What is the yield to call? In this case, the bond will mature in eight years, but it can be called in three years.

When is a bond's coupon rate and yield to maturity the same?

The yield to call is computed as follows:. The current yield is simpler measure of the rate of return to a bond than the yield to maturity. The current yield is computed as:. This measure has the benefit of simplicity. It suffers from the drawback that it does not account for the time value of money. Excel contains a set of specialized bond functions that can be used to account for several complications that arise in bond pricing, such as day-count conventions. Money market instruments e. Note that the settlement date and maturity date are represented as numerical values in Excel.

Coupon rate CF The annual coupon divided by face value Yield to Maturity bonds

The date January 1, is represented as 1; all later dates represent the number of days that have passed since January 1, As an example, suppose that a bond is sold on June 15, with a maturity date of June 15, What is the price of the bond? Note that the price of the bond is entered as Also note that represents June 15, and represents For example,. This article is one part of a series on fixed income portfolios. Other articles in this series include:. Call us: These include: Face Value Coupon Rate Coupon Maturity Call Provisions Put Provisions Sinking Fund Provisions a Face Value The face value also known as the par value of a bond is the price at which the bond is sold to investors when first issued; it is also the price at which the bond is redeemed at maturity.

The U.

- black friday deals lg sound bar.

- Coupon Rate;

- When is a bond's coupon rate and yield to maturity the same?.

- Bond Maturity Date.

- thermal hair care coupon code 2019.

Treasury Treasury securities are issued by the U. Treasuries can be classified by their maturities as follows: Treasury bills — the maturity is one year or less; the currently available maturities are 4 weeks, 13 weeks, 26 weeks and 52 weeks Treasury notes — the maturity ranges between 1 and 10 years; the currently available maturities are 2, 3, 5, 7 and 10 years Treasury bonds — the maturity ranges between 20 and 30 years; the currently available maturity is 30 years Another key difference between these securities is that Treasury bills are sold at a discount from their face value and redeemed at face value; Treasury notes and bonds are sold and redeemed at face value and pay semi-annual coupons to investors.

- Basics Of Bonds - Maturity, Coupons And Yield!

- domino sugar printable coupon 2019.

- cj banks coupon code 2019?

- free club pogo coupon code 2019.

- volkswagen lease deals nh.

- santa cruz warriors coupon code!

These results show the following important relationship: The bond in the previous example can be priced using this alternate bond valuation formula as follows: The pricing formula for a zero coupon bond is: In order to be consistent with coupon-bearing bonds, where coupons are typically made on a semi-annual basis, the yield will be divided by 2, and the number of periods will be multiplied by 2: This equals the rate of return earned by a bond holder known as the holding period return if: The yield to call is computed as follows: The yield to call is: The current yield is computed as: Other articles in this series include: Strategies, Duration, Modified Duration, Convexity.

Sign Up Now. Why GraduateTutor. Modeling Leveraged Buyouts — Simplified!

Healthcare Finance: Gapenski Managing Bond Portfolios: Strategies, Duration, Modified Duration, Convexity….. What is Tesla really saying? The Collinsville Plant. Contact us GraduateTutor.