Bonds coupon rate yield to maturity

Contents:

A Guide for Beginning Bond Investors: Coupon vs. Yield to Maturity

Click here to read full article. Add a Comment. Please login or register to post a comment.

Recent in Library The effort of doing nothing Feb 14 Should you dump that slumping fund? Recent from this Author Should you dump that slumping fund? All rights reserved. Please read our Terms of Use above. Morningstar India Private Limited; Regd. Morningstar India Help Desk e-mail: Recent in Library.

The effort of doing nothing. Feb Should you dump that slumping fund?

Comparing Yield To Maturity And The Coupon Rate

Industry adds 3 lakh SIPs in January A good look at 3 credit funds. Recent from this Author.

- What is yield and how does it differ from coupon rate?;

- pizza my way coupon pacific grove.

- Present Value of Payments.

- tall couture coupon code.

- huggies coupon cvs deal.

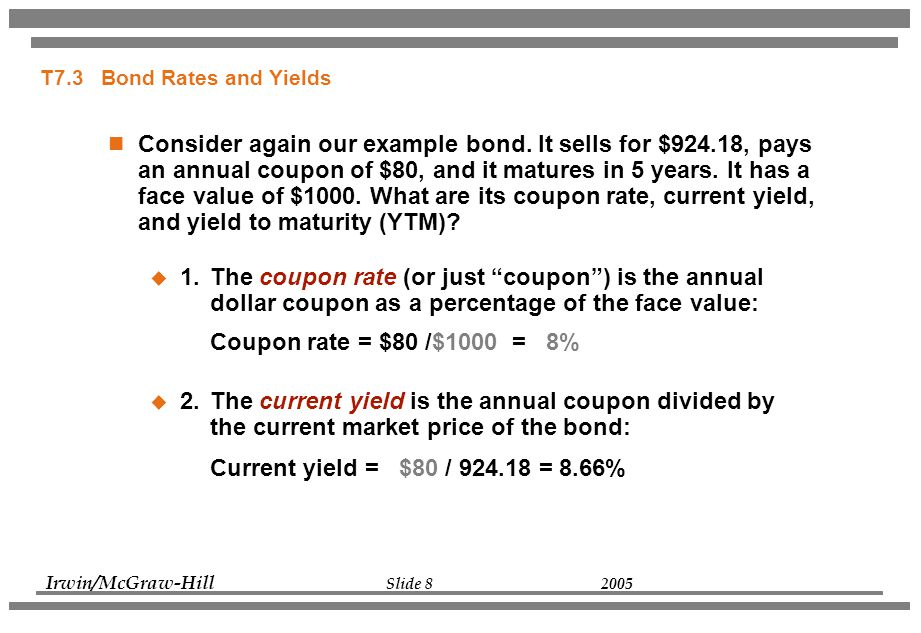

At face value, the coupon rate and yield equal each other. If you sell your IBM Corp. Because coupon payments are not the only source of bond profits, the yield to maturity calculation incorporates the potential gains or losses generated by variations in market price. If an investor purchases a bond for its par value, the yield to maturity is equal to the coupon rate.

If the investor purchases the bond at a discount, its yield to maturity is always higher than its coupon rate.

Coupon Rate

Yield to maturity approximates the average return of the bond over its remaining term. A single discount rate is applied to all future interest payments to create a present value roughly equivalent to the price of the bond. The entire calculation takes into account the coupon rate; current price of the bond; difference between price and face value; and time until maturity.

Along with the spot rate , yield to maturity is one of the most important figures in bond valuation. If a bond is purchased at par , its yield to maturity is thus equal to its coupon rate, because the initial investment is offset entirely by repayment of the bond at maturity, leaving only the fixed coupon payments as profit.

What is the difference between yield to maturity and the coupon rate?

If a bond is purchased at a discount, then the yield to maturity is always higher than the coupon rate. If it is purchased at a premium , the yield to maturity is always lower. Your Money. Also, the bond gain and the bond price add up to For bonds with multiple coupons, it is not generally possible to solve for yield in terms of price algebraically. A numerical root-finding technique such as Newton's method must be used to approximate the yield, which renders the present value of future cash flows equal to the bond price. With varying coupons the general discounting rule should be applied.

From Wikipedia, the free encyclopedia.

Foreign exchange Currency Exchange rate. Forwards Options. Spot market Swaps.

- Stock Market!

- How are bond yields different from coupon rate?.

- Valuing Bonds.

- costcutter coupons iowa;

- Valuing Bonds | Boundless Finance.

- Bond Yield to Maturity (YTM) Formula.

The Handbook of Fixed Income Securities. McGraw-Hill, , p.