Best refinance deals 2019

Contents:

Qualifying cars must be less than eight years old and have less than , miles on the odometer. Once you pre-qualify, you submit your credit application which involves selecting the length of the loan and the corresponding APR.

Best mortgage tips for February 12222

This will get posted to your consumer credit report. You'll finalize the deal by providing your VIN, E-Sign your contract, provide your lender details, and send in supporting documents such as proof of insurance. Capital One does not charge an application fee, however, each state charges a variable title transfer fee. If you opt for an auto loan refinance from Bank of America, you get a trusted financial institution — and a decision in less time than it takes you to tie your shoes.

Bank of America's current APR for refinancing a vehicle is 4. It is smart to pay off your existing loan with proceeds from a new loan to take advantage of lower monthly payments, lower interest rates, or save on financing costs. Compare prices and use a car loan calculator to help determine the savings.

- How to refinance your mortgage in | stuntmomfilm.com.

- Best Mortgage Deals - compare rates from 90 lenders | finder UK?

- fiji accommodation deals coral coast.

- car hire deals europe.

- coupons jessica jones?

Want to learn more? Check out our full review of Bank of America. They often cater to clients who have improved their credit score in the time since they took out their original auto loan, and because of this, they are usually able to offer steeply discounted loans. On their site, you can compare offers for loans from many different lenders without having to fill out more than one application. They also pull your credit with a soft check, which is easy on your credit score and a great option if you are not seriously considering refinancing your loan right this second once you pick a final offer, they do run a hard pull — but not until you are ready to commit.

How to refinance your mortgage in 12222

AutoPay makes it easy to shop around and often partners with credit unions. The lowest rate offered by AutoPay is 1. The average credit score of an AutoPay customer is which receives, on average, a 5.

Knowing your credit score ahead of time makes a big difference in estimating what your APR will be on refinancing a car loan. Potential lenders are required to provide you with an estimate, which is a three-page document that details your loan terms, projected payments, closing costs and other fees.

Credit Cards

To get the best possible deal, get quotes from a mix of lenders, including bigger banks, local banks and credit unions. You can work with a mortgage broker to choose a lender. It may lead to a better rate, but be aware of hidden costs or fees for the service. Read the fine print of the fees associated with each lender and factor these in to your research. Your approval and interest rates are determined in part by your credit score.

The higher your credit score , the lower your interest rate. Learn how to boost your credit score. Pull your credit report from the three major credit-reporting agencies. If you find any errors, dispute them by contacting the credit bureau. This is the percentage of your gross income that your debt payments eat up, including student loans, credit card payments and your potential mortgage payments.

The lower your DTI, the better. For the best refinancing rates, do everything to reduce your debt.

Best mortgage lenders of 12222: review

Maintain a good credit score by paying down your debt and resisting the urge to open new lines of credit or making big credit card purchases. This can lower your interest rate and reduce your interest payments over the life of the loan. As tempting as it is, it also increases your loan-to-value ratio, which causes your interest rate to spike. Enter Uncle Sam.

You might still be paying for mortgage insurance, a fee that protects the lender if you default on your loan.

If your home has appreciated over time, you may not need the same level of mortgage insurance. Refinancing or lowering your premiums can save you a lot of money, especially if the FHA backed your original loan. Rates go up and down depending on the economic and political climate, and the processing time for loans can take weeks or months. There are several reasons to refinance your mortgage, and those goals guide the process from the get-go.

Refinancing your home loan could free up hundreds of dollars per month for savings, investments and debts — or you could put that money towards your monthly mortgage payment to pay off your loan sooner. While refinancing to lower your payment may increase the term of your loan, it might make the most financial sense. Interest rates are at historic lows. Along with saving you money, reducing your interest rate can also lower your monthly payment and help you build equity in your home.

Keep in mind that taking out a new loan means paying new closing costs. If your income has increased, you may be able to afford higher monthly payments. In that case, you might want to refinance to a shorter loan. For example, from a year fixed to a year fixed to pay off your mortgage faster. Lower monthly payments have you paying interest longer, costing more in the long run.

When you have an adjustable-rate mortgage ARM , your monthly payment can go up and down as interest rates change. That can change your monthly payments dramatically, so refinancing for a fixed-rate loan with stable payments can offer homeowners a sense of security and set payments for easier budgeting.

Best Mortgage Tips For February | stuntmomfilm.com

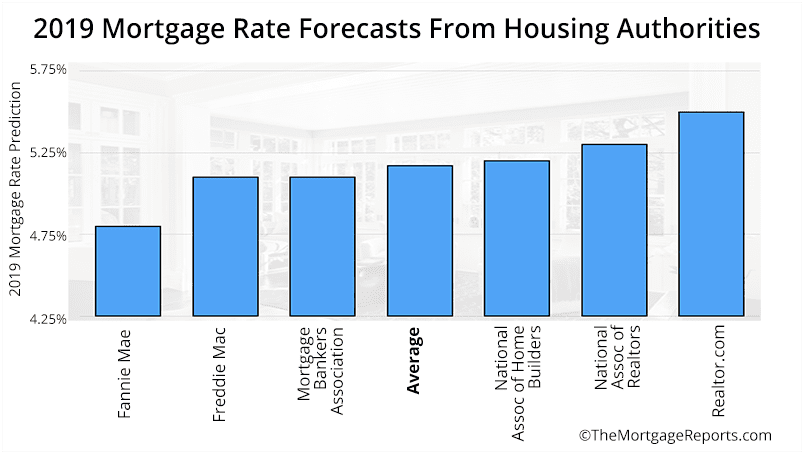

Since interest rates are low, locking in a fixed rate now protects you from any rises in interest rates over the life of your loan. As rates continue to rise, banks will see their short-term funding costs increase, and are likely to pass those increased costs on to borrowers in the form of higher interest rates.

If you're thinking about refinancing this year, the long-term rise in interest rates means that you should start shopping for mortgages soon. At March's average rate of 4. This illustrates how important it is to shop across multiple lenders to make sure you're getting the best deal possible. For homeowners considering a cash-out refinance, higher mortgage rates mean that it may be more efficient to obtain a home equity line of credit HELOC.

If most of the rates above are higher than your original mortgage rate, then a cash-out refinance would mean paying a higher rate on your entire balance for the full remainder of your mortgage term. For more information on how to navigate the mortgage experience, take a look at our informational guides and reviews of popular mortgage lenders.

The listings that appear on this page are from companies from which this website and Bankrate may receive compensation, which may impact how, where and in what order products appear. These listings do not include all companies or all available products.

Neither Bankrate nor this website endorses or recommends any companies or products. Advertiser Disclosure: