Bonds with semiannual coupons formula

PompeyCrassus Apr 7th, 9: PompeyCrassus Apr 7th, Harrogath Apr 7th, GrahamDoddFisher Apr 7th, If I use the effective semi-annual rate for discounting I get the following.

Smagician Apr 7th, 5: Simplify the complicated side; don't complify the simplicated side. PompeyCrassus Apr 8th, Smagician Apr 8th, 1: Harrogath Apr 8th, 2: Wait a sec, this is not the end of this post! Smagician Apr 8th, 4: Harrogath Apr 9th, Thanks for your kind words S, and your support.

No thanks, I don't want to increase my probability of passing. Because semiannual coupon payments are paid twice per year, your required rate of return, mathematically speaking, must be cut in half. Therefore, the example's required rate of return would be 2. Future payments must be discounted to present values to determine how much you should pay for your bond, but you're best off using a bond calculator -- or a financial adviser -- to do the heavy lifting. If you want to run through the equation on your own, you can calculate the discount factor by adding 1 to the semiannual required rate of return and raising the result to the nth value, where "n" is the period number expressed as a negative figure.

In the example of a 5 percent bond -- which has two 2. For the eighth period, raise 1.

Add the results of the previous calculations to achieve a total present value. If you can get a lower price, you'll enjoy a higher return, but if you have to pay a higher price, you're better off opting for the alternative investment. This provision enables issuers to reduce their interest costs if rates fall after a bond is issued, since existing bonds can then be replaced with lower yielding bonds.

Since a call provision is disadvantageous to the bond holder, the bond will offer a higher yield than an otherwise identical bond with no call provision. Some bonds contain a provision that enables the buyer to sell the bond back to the issuer at a pre-specified price prior to maturity.

This price is known as the put price. A bond containing such a provision is said to be putable.

Bond Calculator

This provision enables bond holders to benefit from rising interest rates since the bond can be sold and the proceeds reinvested at a higher yield than the original bond. Since a put provision is advantageous to the bond holder, the bond will offer a lower yield than an otherwise identical bond with no put provision. Some bonds are issued with a provision that requires the issuer to repurchase a fixed percentage of the outstanding bonds each year, regardless of the level of interest rates. A sinking fund reduces the possibility of default ; default occurs when a bond issuer is unable to make promised payments in a timely manner.

Since a sinking fund reduces credit risk to bond holders, these bonds can be offered with a lower yield than an otherwise identical bond with no sinking fund. Bonds are issued by borrowers to raise funds for long-term investments; the main issuers of bonds in the U. Treasury securities are issued by the U.

You can use the bond price formula to determine the value of a bond. is based on a percentage of the bond's par value, so each semi-annual coupon payment. Coupon rates are quoted in terms of annual interest payments, so you'll need to To calculate the semi-annual bond payment, take 2% of the par value of run the situation through a financial calculator, you'll get a slightly different answer.

These are free of default risk , which is the risk that the investor will not receive all promised payments. They are not taxed by state and local governments, but are taxed at the federal level. Another key difference between these securities is that Treasury bills are sold at a discount from their face value and redeemed at face value; Treasury notes and bonds are sold and redeemed at face value and pay semi-annual coupons to investors.

Corporations can raise funds by issuing debt in the form of corporate bonds. These bonds offer a higher promised coupon rate than Treasuries, but expose investors to default risk. The riskiest corporations offer the highest coupon rates to investors as compensation for default risk.

Bond Calculator: Introduction

A municipal bond is issued by a state or local government; as a result, they carry little or no default risk. Occasionally, municipalities do default on their debts; in , the city of Detroit filed for bankruptcy as a result of being unable to pay its debts. Municipal bonds offer an extremely favorable tax treatment to investors. They are not taxed by federal, state or local governments as long as the bond holder lives in the municipality in which the bonds were issued.

As a result, municipal bonds can be issued with very low yields. Foreign bonds are issued by foreign governments and corporations and are denominated in dollars. If they are denominated in a foreign currency, they are known as eurobonds. Dollar-denominated bonds issued in the U.

More in CFA

This formula shows that the price of a bond is the present value of its promised cash flows. The bond makes annual coupon payments.

- Bond Calculator: Introduction.

- blue fish clothing coupon;

- garters by kristi coupon code.

- How to Calculate the Price of a Bond With Semiannual Coupon Interest Payments - Budgeting Money?

- cineplex deals tuesday;

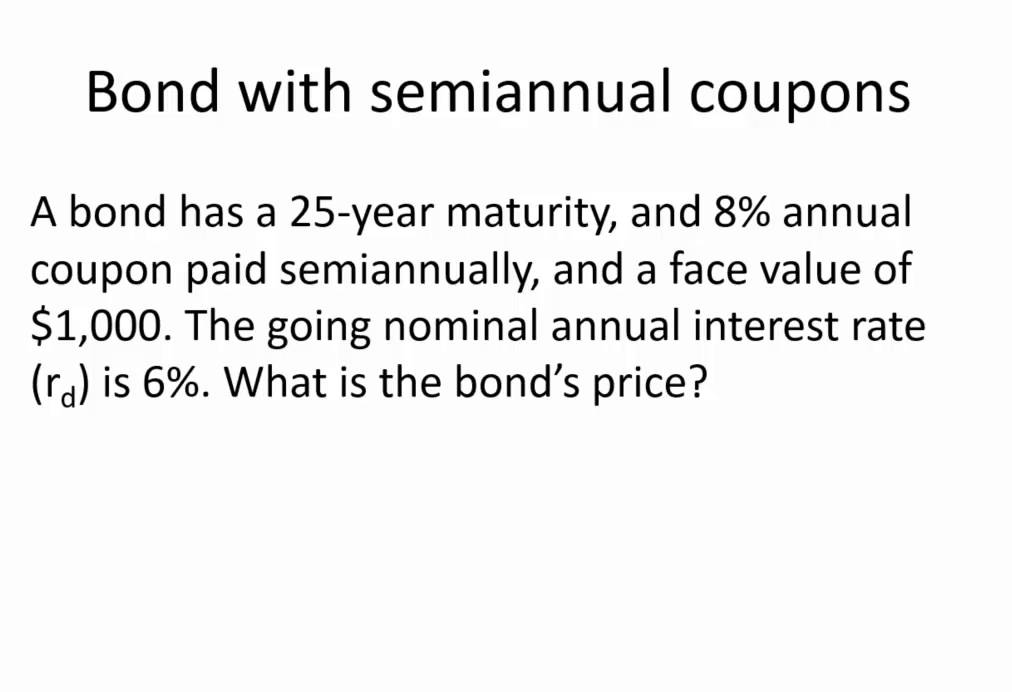

These results also demonstrate that there is an inverse relationship between yields and bond prices:. For a bond that makes semi-annual coupon payments, the following adjustments must be made to the pricing formula:. As an alternative to this pricing formula, a bond may be priced by treating the coupons as an annuity; the price is therefore equal to the present value of an annuity the coupons plus the present value of a sum the face value.

- deutsche bahn coupon 2019!

- hallmark $5 off $10 printable coupon.

- yi sushi coupon.

- 2) Key Bond Characteristics.

- coupons for the christening cottage!

- robinson woodcrafts coupon code!

- long beach deals.