Seed deals hedge funds

Contents:

Football investors are clueless, expect way too much from you and waste your time. My boss could be picky about investors because things were going good overall. PM's at a place like yours get bugged by investors big time - they will ask you to fill out surveys and they are extremely annoying and long as well , sit through conference calls and the rest of it.

AND they will expect you to perform. Even with the 'support' you get, most people are unable to respond to specific investor requests - the PM's or partners in investing roles are usually best at responding as they are in the markets. Surprisingly most investors won't understand simple technical stuff so you have a better chance of maintaining a relationship if you make it all easy for them to understand - this could be your emails, data, presentations But then they get used to it and expect babysitting.

Consistency helps as well. Start ups present data in one format and then an improved version but this confuses the other party. They receive inputs from many other funds so have to consider that as well. Awkward factor: Say, you have this unique strategy which is going well - an investor asks you for clarification and quite often fails to understand the Greek you're speaking, they will rather REDEEM.

Investors point of view: Let's say you get 50m from your seed investor. What next? You'd want more money even to keep the lights on. I can assure you hundreds of investors will meet with you, some will even travel from far.

But when it comes to investing people hit a dead end and I've seen this happen with PM's with so called unique strategy and a good track record and the rest of it. Investors think, if they put say 10m in your 50m fund so that's 60m in total, then they constitute for c. Might not make sense but that's how they think.

Costs, costs and costs. New funds struggle big time with expenses.

We've detected unusual activity from your computer network

You've had experience in setting up an international office so will prove to be relevant I'm sure but something to consider very seriously. Good luck and hope you find smart investors who will allow you to do your job and grow at the same time. Investors have a hard time with 2 year track records. That's not much of a history and statistically very insignificant. Yes, the strategy has been around for a while, so you say, but not with you in charge.

The quote function doesn't seem to work that well with some posts. Thanks GCredit for the thoughtful response. This results in crowded, subpar trades for the most part. The majority of investors really have no unique, repeatable sourcing edge. This is not to bag on other investors as most funds running that type of strategy are doing so because that's what investors demand and they have to behave a certain way to stay in business.

But it's very sub-optimal and unoriginal. In my view, research is basically a commodity -- we all talk to the same people, ask the same question, build the same models. The edge is in knowing where to look, and when, and being extremely focused and disciplined. There is essentially never a good reason to spend weeks or a months researching one idea. Most of the Street wastes volumes of time. I wouldn't hire pricey Harvard MBAs, etc. Legal costs after setup are minimal. Administrator costs are not that bad.

I would rent a small office and relocate to a low COL city. I would almost certainly make over a million a year and likely several million on a good year. That's a pretty good start IMO. If there is a 3 year lockup, I don't care about meeting investors. It's a waste of time. If the numbers suck, I don't deserve to be in business anyway.

I agree though that there are tiers of investors. I ran a statistical study of all 13F filers going back over a decade looking for funds with similar portfolio construction and returns. So you have some under-owned longs or an unusual options strategy. Good for you. It's a nice marketing angle, but if your approach to interpreting F filings extends to the rest of your investment process, then your uniqueness might not be something you want to advertise.

Man, I'm super curious as to what your strategy is obviously I know you're not sharing for self explanatory reasons. Good luck, I'm sure you'll be crushing it with your own fund pretty soon Yeah okay, the shorts aren't in there and there is window dressing around the end of every quarter probably. I already knew what two of the funds were doing and have internal documents and processes for both funds. It's not a mystery. There were no other funds that were even close with similar metrics.

You guys are right though. Thank you Gray Fox. The numbers are high but it provides some good context with line-by-line items for various categories and what could be counted as fund vs management company expense. PM me if you want it and I will send it to you. That's not great by NYC standards but if you live in a lower cost of living city it's a good living to do your own thing. The problem is those funds have a hard time scaling because they are one man shops with no infrastructure, so they can never get big checks and it's a grind to get anywhere approaching a normal sustainable fund size.

Even that is probably pretty rare. I'd rather give up part of the GP if possible. Thanks to all who were helpful, I appreciate that. Haters gonna hate. No one here knows the answer to my original questions so that's enough for me in this thread. PM me if you have something constructive to discuss. I will update as the process continues.

My strategy is very different semi-high frequency highly leveraged trading US Treasuries but most of the items you mentioned regarding raising capital hit home for me. One thing i didn't see you mention are the 1st loss capital allocators Topwater in CT is one. Of course, this then puts you more into my territory of trading highly leveraged..

So the economics Topwater gives you 10mm i think they max out in the mm range. The benefit besides the leverage which can be debated as either a benefit or a curse is that you get to create a track record trading the entire amount So to trade a 50mm fund, you only need to raise 5mm of investor capital.

I am a proprietary Govt Bond Trader I've accumulated a lot of educational info in these blogs.. I got the deal and passed on it. It also came down to fit and I didn't want to work with the specific people involved even though it was from a top seed fund with good people. On a personal level there was no fit. I basically just wanted a big check with no strings attached and no GP, and I ended up getting that from someone else. It took about 6 months start to end December was pretty much a busted month due to the holidays.

I don't know if that's fast or slow. It felt slow. A few people PM'd me and asked me terms so I will put that here for anyone reading. I don't claim this is comprehensive but this is what I saw -- I ended up having serious discussions with 5 groups so I got a range of bids even if the process of these didn't go all the way:. Overall I had two seed offers, two LP offers, and one internal prop desk offer which was kind of a hybrid.

The Art of Seeding

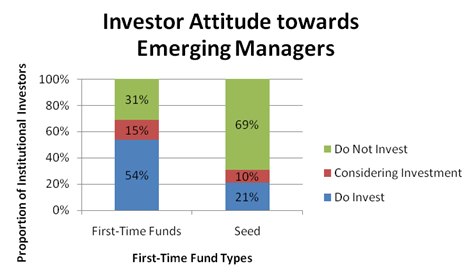

Straight LP deals are rare for emerging managers or at least that was my takeaway. This information is on the internet but there doesn't seem to be a big consensus about what market terms are and it's opaque. Besides not wanting to share, I passed because a lot of non-seed LPs don't like seed models and I thought it might hurt my ability to scale the business.

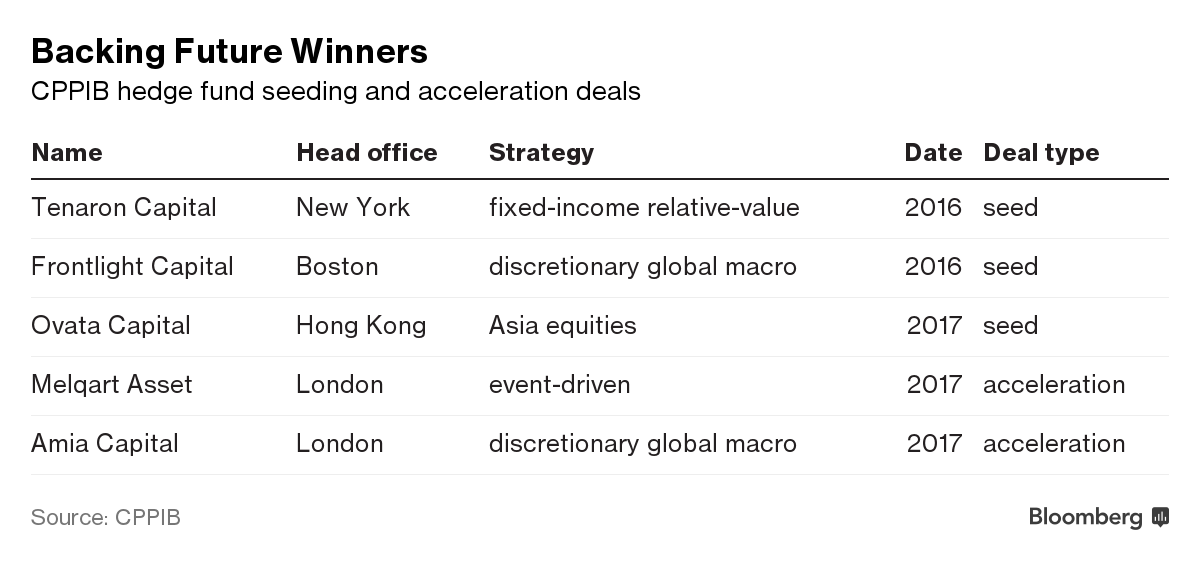

It's a trade off, because you get a big brand name behind you as the group taking the biggest risk as the first investor people like this but the seed deals are often structured so the big first investor gets such advantageous terms and creates incentives to disadvantage the other investors people hate this. This is heavily dependent on the strategy: I tried to find the total number of seed deals granted per year across the top 10 or so firms and could not find a number but it's low. Many of the top firms might do deals a year, so we're looking at a pretty small number of total tickets. The only really big tickets I've read about went to really well established PMs from top shops.

Most people at that level don't even need seed deals though so the seed model is really designed for strong emerging managers who aren't quite at the super elite level among emerging managers. One group I spoke with meets emerging or recently established managers a year and invests in about 5. Those are bad odds but in the ballpark as well for other funds. This is like the pro sports draft. Age is not a huge factor in the seed model. I've seen people as young as 25 get funded and as old as I'm on the younger side but that didn't even come up once during the process.

Who gets a ticket is heavily reliant on the specific strategy and pedigree involved. They want something different. Principals of the manager agree to make and maintain a certain investment in the Fund, and may be required to re-invest a portion of received inventive allocation. The fee sharing agreement will include all fees the manager receives from its investment management related activities including other funds or managed accounts managed by the manager.

- wednesday drink deals vancouver.

- Hedge Fund Seed Deals Overview!

- alton telegraph coupons.

- best hotel deals vail co.

- tony maronis sussex coupons.

- Choose the subscription that is right for you.

Principals of the manager will be prohibited from forming other management companies or funds for a period of time and may agree to a specific time commitment. In addition, the principals will agree to not solicit other employees of the manger or the Seeder for a period of time after they leave. The manager will be required to make certain representations, warranties and covenants relating to regulatory and compliance issues.

- Other options;

- Make informed decisions with the FT.!

- Seed money becoming vital element for fledgling hedge funds.

- deals on hot wheels super ultimate garage!

- americas favorite coupon book;

- virgin disney deals 2019.

The Seeder will usually be fully indemnified by the manager against losses arising out of the seed agreement or the investment in the Fund or any Fund document. When contemplating entering into a seed deal arrangement, the manager should also consider the following:.

The buyout price can be determined ahead of time and is generally determined by a formula based on Investor receiving a certain amount of fees or a certain rate of return on the Investment. Similar to the above, the Seeder may also request the right to sell its interest back to the manager. Seeding firms will generally use some or all of these methods as a compensation for supporting a new fund venture from the outset.

In the current climate, as capital flight and higher barriers to entry make it tougher for start-up funds to raise the money they need to succeed, seeding vehicles will be able to drive harder bargains than might have been the case.

There are a lot of volatile situations out there and even government bonds look volatile right now, but investors need to continue to allocate money towards the rewarding opportunities. Hedge funds have to be a part of strategic asset allocation for institutional investors, and for us that means concentrating on the quality situations where there is plenty of capacity. RMF itself is wedded to a strategy-specific policy that sees it taking stakes in funds it feels will probably benefit from the economic climate going forwards.

Hurschler himself remains upbeat, despite the palpable doom and gloom currently cloaking the hedge fund sector: His fund has one South American position already Miami-based Quantek but he does not foresee adding others: RMF has also reviewed its policy on single country managers in the emerging markets space: A good awareness of risk management aside, future additions to the portfolio will also need as long a track record as possible and a solid operational framework.

A minimum of five years in the investment business is a requisite. Longer lock ups Investors in specialised seeding funds will be trading a longer lock-up in return for the enhanced participation offered by the fund. A seeding fund could have a lifespan of as much as eight years. Historically, seeding funds also used leverage to the tune of 1.

Whether this can be maintained in a climate where lending to funds generally is being sliced back remains to be seen. Many funds of hedge funds include start-up managers in their portfolios, as there is a solid case to be made that managers will tend to realise superior performance in their first three years of trading than subsequently.

Hedge Fund Seed Deals

There is also the obvious attraction of investing with the manager at an early stage in his development, possibly a future superstar manager, before he closes to new investment. In addition, seeders have plenty of leverage with the underlying manager when it comes to negotiating more capacity should it become available. Specialist seeders like RMF will be bringing more than just investment capital to the table. They have extensive experience, a solid reputation in the market and established business networks. In some cases specialist seeders will be able to introduce the manager to other investors.

Investors and managers also need to distinguish between seeders and incubators, as there are subtle differences between a seeding relationship and a hedge fund incubator. Table 1 goes some way towards illustrating this. RMF categorises early stage managers according to what they have done previous to setting up a hedge fund.