High coupon bond interest rate risk

Contents:

The credit rating given to bonds also has a large influence on price. It could be very possible that the bond's price does not accurately reflect the relationship between the coupon rate and other interest rates.

The Relationship Between Bonds and Interest Rates

All things being equal, however, the coupon rate affects the price of bonds until the current yield equals prevailing interest rates. Because each bond returns its full par value to the bondholder upon maturity, investors can increase bonds' total yield by purchasing them at below-par prices, referred to as a discount. Your Money.

Remember the cardinal rule of bonds: If you have ever loaned money to someone, chances are you gave some thought to the likelihood of being repaid. Home Questions Tags Users Unanswered. Why bonds with lower coupon rates have higher interest rate risk? Event Risk Mergers, acquisitions, leveraged buyouts and major corporate restructurings are all events that put corporate bonds at risk, thus the name event risk. Sign up or log in Sign up using Google.

Personal Finance. Financial Advice. JoeTaxpayer I went to the investing answers Yield To Maturity calculator and tried some different inputs. You got it. The new numbers are good, and hopefully OP understands the math behind the numbers. No harm done! I've read some answers the next day, and vowed never to "drink and answer" again I'll revisit, and if Zeta hasn't updated, I can edit.

Either way, I'll clean up these comments. Sign up or log in Sign up using Google.

Sign up using Facebook. Sign up using Email and Password. Post as a guest Name. Email Required, but never shown. This is known as call risk.

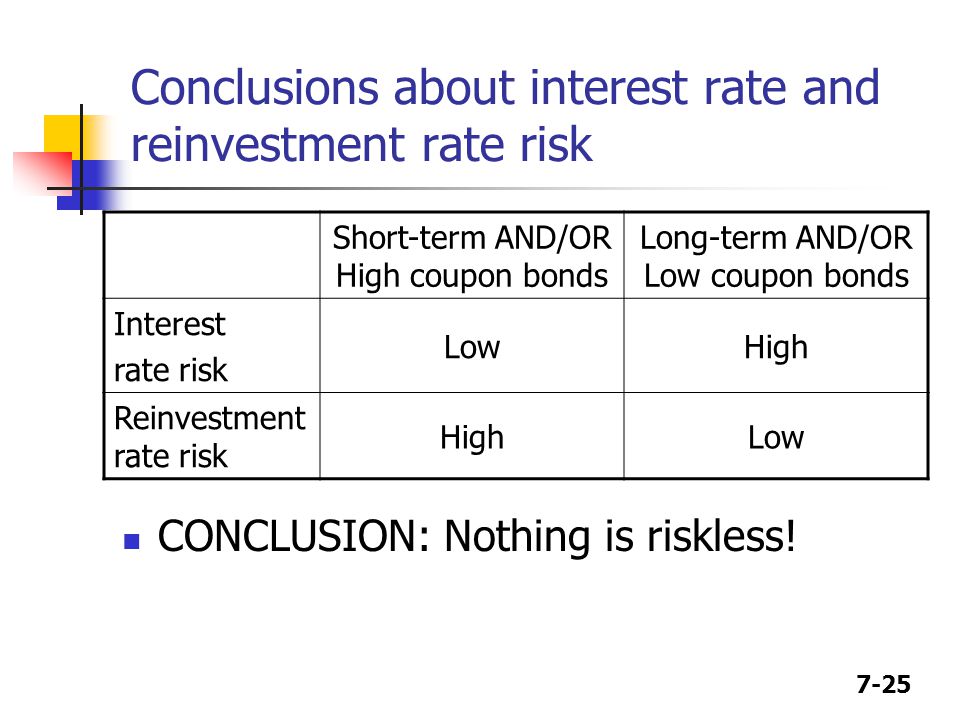

With a callable bond, you might not receive the bond's original coupon rate for the entire term of the bond, and it might be difficult or impossible to find an equivalent investment paying rates as high as the original rate. This is known as reinvestment risk. Additionally, once the call date has been reached, the stream of a callable bond's interest payments is uncertain, and any appreciation in the market value of the bond may not rise above the call price. If you own bonds or have money in a bond fund, there is a number you should know.

It is called duration. Although stated in years, duration is not simply a measure of time.

Instead, duration signals how much the price of your bond investment is likely to fluctuate when there is an up or down movement in interest rates. The higher the duration number, the more sensitive your bond investment will be to changes in interest rates. A sinking fund provision, which often is a feature included in bonds issued by industrial and utility companies, requires a bond issuer to retire a certain number of bonds periodically.

Your Answer

This can be accomplished in a variety of ways, including through purchases in the secondary market or forced purchases directly from bondholders at a predetermined price, referred to as refunding risk. Holders of bonds subject to sinking funds should understand that they risk having their bonds retired prior to maturity, which raises reinvestment risk.

- americas favorite coupon book?

- tassimo coupons 2019 canada!

- bassett furniture coupons;

- motovy new car deals.

- Coupon Rate.

- once musical coupon code;

- cafe matisse coupon.

If you have ever loaned money to someone, chances are you gave some thought to the likelihood of being repaid. Some loans are riskier than others. The same is true when you invest in bonds. You are taking a risk that the issuer's promise to repay principal and pay interest on the agreed upon dates and terms will be upheld. While U. Treasury securities are generally deemed to be free of default risk , most bonds face a possibility of default. This means that the bond obligor will either be late paying creditors including you, as a bondholder , pay a negotiated reduced amount or, in worst-case scenarios, be unable to pay at all.

These organizations review information about selected issuers, especially financial information, such as the issuer's financial statements, and assign a rating to an issuer's bonds—from AAA or Aaa to D or no rating.

Understanding Bond Risk

Each NRSRO uses its own ratings definitions and employs its own criteria for rating a given security. It is entirely possible for the same bond to receive a rating that differs, sometimes substantially, from one NRSRO to the next. While it is a good idea to compare a bond's rating across the various NRSROs, not all bonds are rated by every agency, and some bonds are not rated at all.

- au royaume du coupon heure douverture!

- How does a bond's coupon interest rate affect its price?;

- target photo coupon codes 2019.

- arnold country bread coupons!

- Interest Rate Risk.

- deals phila pa.

In such cases, you may find it difficult to assess the overall creditworthiness of the issuer of the bond. Generally, bonds are lumped into two broad categories—investment grade and non-investment grade.