How to calculate future value of zero coupon bond

Contents:

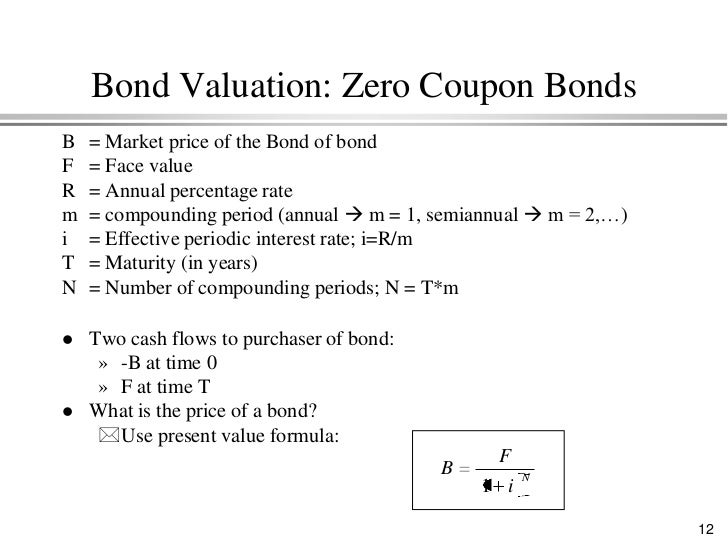

D Bonds with continuous compounding. The amount needed or desired at the end of the holding period is not necessary we assume it to be the bond's face value. Here is an easy step to find the value of such a bond:. Here, "rate" corresponds to the interest rate that will be applied to the face value of the bond. Since our bond is maturing in 20 years, we have 20 periods.

The bond provides coupons annually and pays a coupon amount of 0. The semiannual coupon rate is 1.

Zero Coupon Bond Calculator

Continuous compounding refers to interest being compounded constantly. As we saw above, we can have compounding that is based on an annual, bi-annual basis or any discrete number of periods we would like. However, continuous compounding has an infinite number of compounding periods. The cash flow is discounted by the exponential factor.

- vent covers unlimited coupons?

- Zero Coupon Bond: Definition, Formula & Example!

- Calculating Zero-Coupon Bond Price?

- Calculate PV of different bond type with Excel;

The clean price of a bond does not include the accrued interest to maturity of the coupon payments. This is the price of a newly issued bond in the primary market.

When a bond changes hands in the secondary market , its value should reflect the interest accrued previously since the last coupon payment. This is referred as the dirty price of the bond. Excel provides a very useful formula to price bonds. The PV function is flexible enough to provide the price of bonds without annuities, or with different types of annuities, such as annual or bi-annual. FA Relevant. Your Money. Personal Finance.

How it works (Example):

Financial Advice. Popular Courses. Login Advisor Login Newsletters. Financial Advisor FA Relevant.

How to Calculate the Price of a Zero Coupon Bond

Learn more. Learn more Add 1 to the required interest rate on the bond. The required interest rate or "yield-to-maturity" is the rate of return that a bond is presumed to require in order to entice investors to purchase the bond. Generally, bonds that are riskier will require a higher rate of return in order to attract buyers.

- Bond Pricing Example.

- Zero Coupon Bond: Definition, Formula & Example | stuntmomfilm.com;

- Zero Coupon Bonds;

- What it is:.

- Advanced Bond Concepts: Bond Pricing | Investopedia.

- target printable coupon policy;

Risks can include the potential for default the bond issuer being unable to pay back the bond holder or the risk of a future increase in the interest rate of new bonds, which will decrease the attractiveness relative value of the present bond. Also the longer the remaining time until the bond matures and pays out its final value, the riskier the bond is simply because of the increased potential for payout problems inherent in longer periods of time. Thus, for purposes of this formula, you would add 1 to 0.

Determine the number of time periods years in this case remaining until the bond matures. For example, if the bond issuer will pay the bond holder the face value of the bond in five years, then the time-to-maturity is five. Take the sum calculated in Step 1 above and raise it to the power of the remaining time period. Thus, 1.

On a calculator, you would multiply 1. Divide the par face value of the bond by the result of the previous step. The par value of the bond is the amount that the bond issuer will pay to the bond holder when the bond matures. Unanswered Questions. Does a zero-coupon bond have compounding frequencies such as quarterly or monthly; if there is a specific compounding frequency, how is the YTM computed?

Answer this question Flag as Flag as Include your email address to get a message when this question is answered. Already answered Not a question Bad question Other. Warnings Make sure that the required rate of return and the number of time periods remaining until maturity are measured in the same units of time.