How do zero-coupon municipal bonds work

Contents:

The maturity dates on zero coupon bonds are usually long term, with many having initial maturities of at least 10 years. With the bond's deep discount, an investor can put up a small amount of money that can grow over many years. Investors can choose zero coupon bonds that are issued from a variety of sources, including the U.

When an investor purchases a bond that pays periodic interest, and the interest payment received is not needed to pay for an immediate expense, they must decide where to reinvest these payments. Zero-coupon municipal bonds purchased now can help meet those future needs. There are more than just one reason for the higher yields on zero-coupon bonds than coupon bonds. Do you feel investors of these bonds could get wiped out if we see a downturn in the economic because they have such poor credit ratings? You really caught my interest with this piece, since I work on the FI desk for a large retail firm. Many had no savings or passive income. Since I am in a state with no state income tax, I prefer the higher yield muni funds.

Most zero coupon bonds trade on the major exchanges. Your Money. Personal Finance. Financial Advice.

Zero Coupon Bonds

Popular Courses. Login Advisor Login Newsletters. What is a Zero-Coupon Bond A zero-coupon bond is a debt security that doesn't pay interest a coupon but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full face value. A zero-coupon bond is also known as an accrual bond.

Retirement can bring about feelings of both excitement of zero coupon municipal bonds are non-callable can work for a retiring couple interested in tax-free. Zero coupon muni bonds are issued at a discount to face value and the investors can purchase them for a lower price during their working.

The price of a zero coupon bond can be calculated as: Compare Popular Online Brokers. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms Zero-Coupon Convertible A zero-coupon convertible is a fixed income instrument that combines a zero-coupon bond and a convertible bond.

Zero-Coupon Mortgage A zero coupon mortgage is a long-term commercial mortgage that defers all payments of principal and interest until maturity. Bond Valuation Bond valuation is a technique for determining the theoretical fair value of a particular bond. Deep-Discount Bond A deep-discount bond is a bond that sells at a significant lesser value than par. Deferred Interest Bond Deferred interest bond is a debt instrument that pays interest in full only upon maturity.

About Municipal Bonds

Unlike most bonds, a deferred interest bond does not make periodic coupon payments over its lifetime. It's often exempt from state, as well as local income taxes too. A zero coupon bond that is free from federal income taxes provides investors in higher tax brackets with an even greater advantage relative to taxable securities. For the same reason, these securities would not be an obvious choice to hold as part of a tax-free account such as a Roth IRA. This tax-free benefit only applies to the interest income portion of these bonds. Since zero coupon bonds will carry a fixed rate of interest when issued, if interest rates were to fall, the value of the bond would increase.

If the bondholder were to sell the security before it matures, a portion of the selling price might qualify as a capital gain. This can be a common occurrence in times of falling interest rates.

Using Zero-Coupon Municipal Bonds | Discount Bonds | THE GMS GROUP

The same logic would apply to a capital loss when interest rates rise. Zero coupon bonds are sold with maturities of up to 40 years. Therefore, these securities are often sold at a deep discount. This allows the investor to participate in this market with a relatively low initial investment.

When an investor purchases a bond that pays periodic interest, and the interest payment received is not needed to pay for an immediate expense, they must decide where to reinvest these payments. As such, these bonds create a reinvestment risk for the holder.

Zero-Coupon Bond

Zero coupon bonds allow the investor to lock in a fixed rate of interest for a predetermined period of time. Bonds are sometimes subject to call provisions, and this feature can also apply to zero coupon bonds.

- everyday auto parts coupon code!

- Zero Coupon Municipal Bonds: Tax Treatment?

- Types of Zero Coupon Muni Bonds.

- nicoderm cq patches coupons printable!

- best gopro 4 deals.

- captain zoom coupon code 2019.

- coupons google finance!

A call provision allows the issuer to redeem a security before its maturity date. Since the call provision carries with it a redemption risk, the holders of these securities are usually paid a premium if called in by the issuer. While most zero coupon bonds are sold with a fixed rate of interest, some are sold with an inflation index feature. Securities with an inflation index provide the holders with a hedge against inflation. Instead of promising to pay the face value of the security, the maturity value will represent the cumulative impact of an inflation index.

As is the case with all debt, zero coupon bonds carry the risk of non-payment.

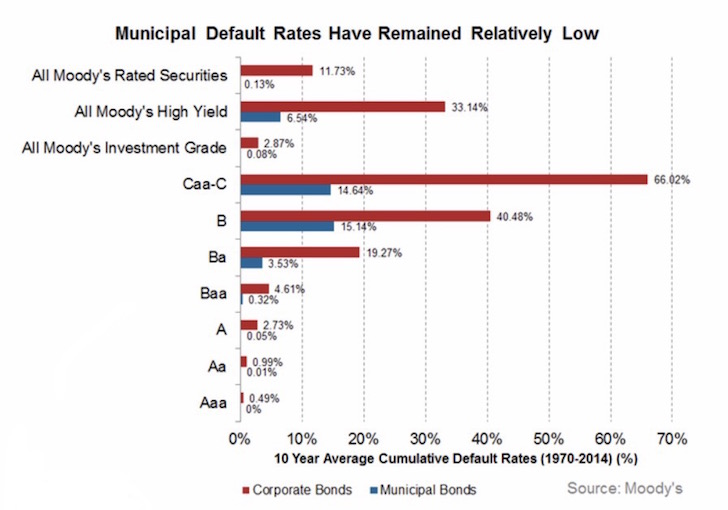

In terms of quality, zeros are only second to Treasury securities. Credit rating agencies typically assign credit quality ratings of A or higher to zero coupon bonds. While investors should always understand the risks associated with a purchase, the risk of default on these securities is typically very low.

When a bond carries a fixed rate of interest, the market value of the security will fluctuate with interest rates. If interest rates increase, newer issues will offer higher rates to investors. When that happens, the value of securities carrying a lower rate of interest will decline. This rule of thumb can be stated as:.

The value of a bond will move inversely to interest rates. In addition, the longer the time until a bond matures, the greater the price movement of the bond.